-

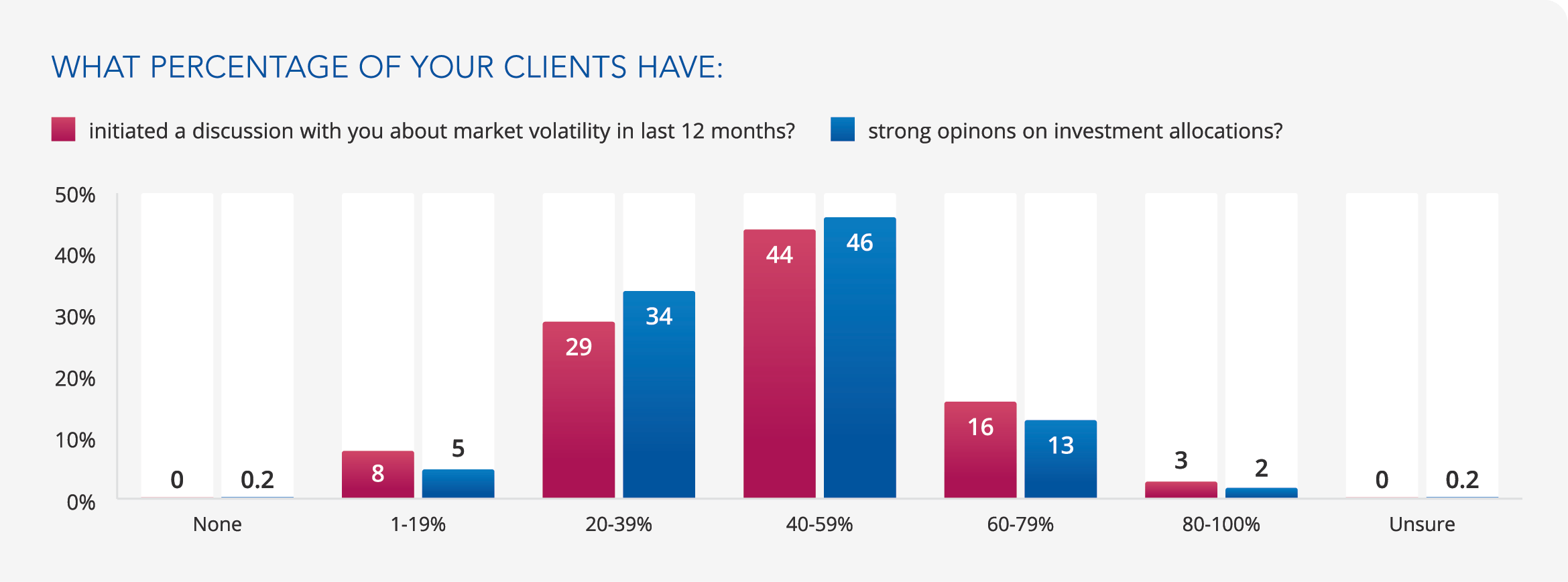

Many advised investors contact advisers as markets fall with strong opinions on allocations

-

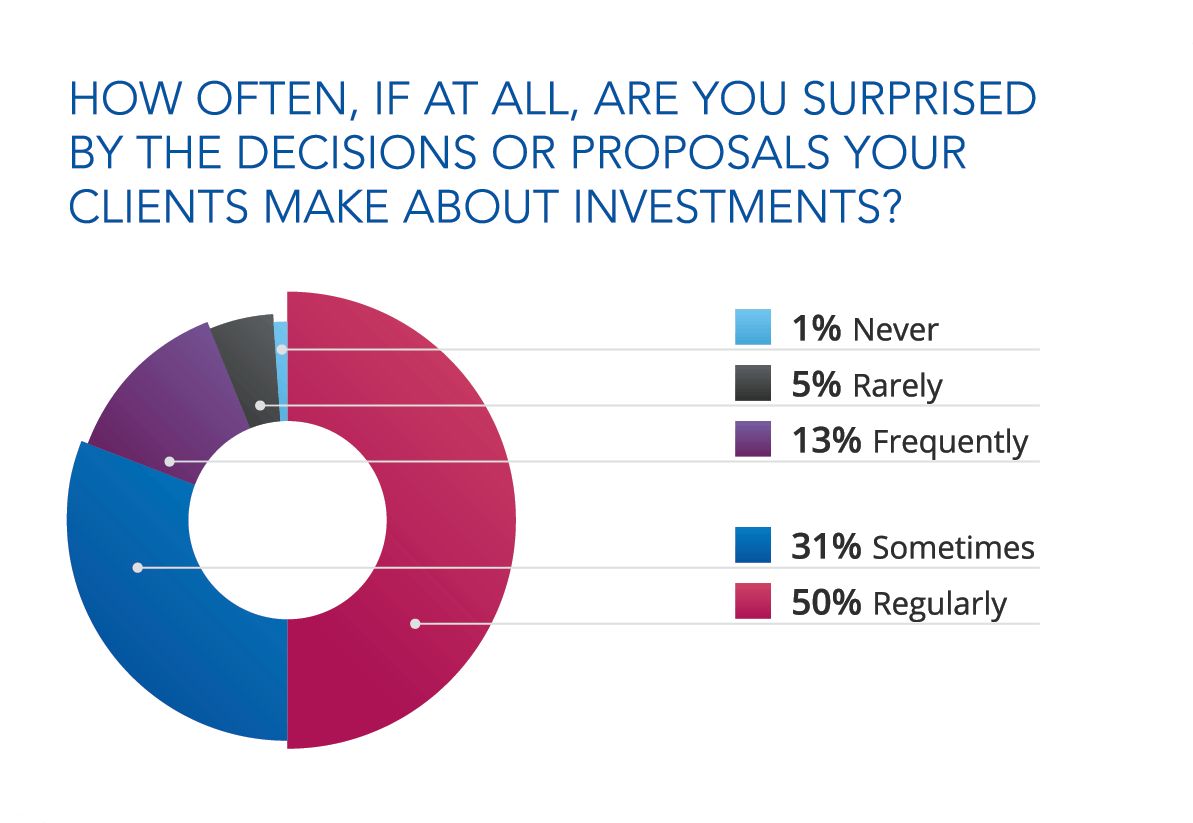

Advisers are regularly surprised by their clients’ investment proposals and decisions

-

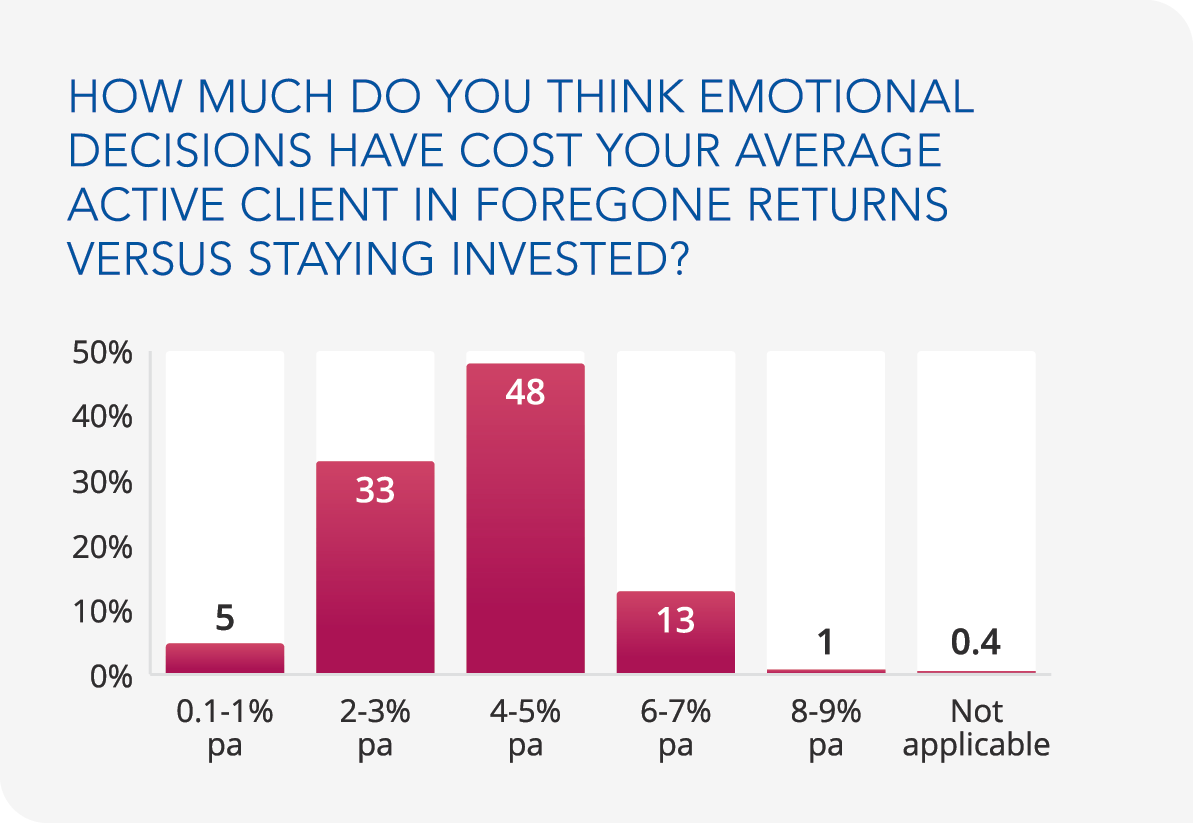

95% of advisers think emotional decisions cost their clients at least 2% pa in foregone returns

Do investors need saving from themselves?

Investors get worried in volatile markets and emotions can lead to mistakes

Our latest survey reveals many investors are contacting their adviser due to worries about short-term market moves. Advisers told us that, on average, 44% of their client base have initiated contact with them to discuss market volatility in the last 12 months, while 61% of advised clients reported they had discussed volatility with their adviser over the same timeframe. These are surprisingly high numbers given the long-term nature of investing.

But they may be understandable given that many pension funds hit high watermarks in recent years, which can act as psychologically important levels. When investors experience a decline in their accounts, behavioural finance theory suggests the pain from the loss is felt twice as much as the pleasure from a gain.

The emotional pain of market corrections can be a problem for wealth accumulation if it leads some investors to make snap decisions, like selling when markets are down. Our survey suggests this is a significant risk advisers must manage with their clients, since the average adviser in our survey reports that 45% of their clients also have strong opinions on asset allocations.

More worrying is the fact that a 63% majority of advisers are ‘frequently’ or ‘regularly’ surprised by the proposals or decisions their clients make about investments (31% are ‘sometimes’ surprised; only 6% were rarely or never surprised). And, when asked about the investing mistakes clients do make, advisers believe that the biggest one is being too influenced by current news events when making decisions. The second biggest mistake was taking too little risk.

There is a cost attached to emotional decisions if they mean taking too little risk due to short-term gloomy news coverage. When we asked advisers to put numbers on it, the results were particularly revealing. A sizeable 48% of advisers believe emotional decisions cost their average active client 4-5% per annum in foregone returns. 33% of advisers believe their average active client gives up 2-3% pa. Incredibly, a net 95% majority of advisers think emotional decisions cost their average active client at least 2% pa.

Advisers show their value by protecting investors from themselves

We now have a picture of market volatility and gloomy news driving increased adviser contact and caution among certain investors, which may be costing them dearly in foregone returns. A key part of the adviser’s role is to build emotional resilience and staying power with the client throughout their investment journey. The fact that older, more experienced advised clients were less likely to contact their adviser bears this out. 71% of advised clients in the 35-44 age group contacted their adviser to discuss volatility in the last year, but only 54% of 55-64 year olds. Evidence perhaps that the first correction investors experience is always the worst.

It was investing guru, Benjamin Graham, who said “the investor’s worst enemy is likely to be himself” in the Intelligent Investor, published in 1949. These findings show that remains as true today. Indeed, the ability to check investment accounts daily on a smartphone may have made the problem more pronounced. Encouragingly, advised investors show a greater awareness of emotional pitfalls than non-advised investors. The fact that 64% of advised consumers agree that their adviser helps them avoid emotional decision-making reaffirms not only the value of advice but the benefit of outsourcing investment decisions to mitigate the problem of emotional bias.

“These survey results reveal the critical role that advisers play in providing ‘after sales’ guidance to investment recommendations so that clients don’t get blown off course by market dips. The fact find is just the start of the adviser-client investment journey – one where advisers can begin to prepare clients by showing the impact of previous corrections when discussing capacity for loss. Once an investment course has been set however, a critical and ongoing part of the adviser’s role is mentoring the client through volatile times to build deeper resilience to corrections and regularly re-focusing them on the long-term outcome and not the path of short-term returns.”

Barry MacLennan

Chief Executive Officer, Embark Investments